Overview of Mauritius' AML/CFT/CPF Compliance and Ongoing Initiatives

| Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) Unit

|

| | Through this unit, the Ministry functions as the apex coordinating body in the field of anti-money laundering

and combatting the financing of terrorism and proliferation (AML/CFT/CPF). The key roles of the Unit are to

ensure:

|

| (a) compliance with the FATF Standards and international best practices;

|

| | (b) effective national coordination and cooperation among all AML/CFT stakeholders; |

| | (c) that AML/CFT reforms are sustained and enhanced to effectively address the evolving threats and vulnerabilities; and

|

| (d) capacity building to effectiveness of AML/CFT/CPF officers, enabling them to better detect, prevent and respond to ML,

TF and PF.

|

|

The objectives of the AML/CFT Unit's are to:

|

| * Sustain Mauritius' efforts in the fight against money laundering (ML), the financing of terrorism (TF) and proliferation (PF).

|

| * Continue to undertake initiatives to respond to growing risks with respect to money laundering, the financing of terrorism

and proliferation.

|

| * Ensuring that Mauritius continues to adhere to the FATF Standards.

|

| * Raise Mauritius's visibility as a key hub in combating Money Laundering/Terrorist and Proliferation Financing in Africa.

|

| Compliance with FATF Standards

|

-

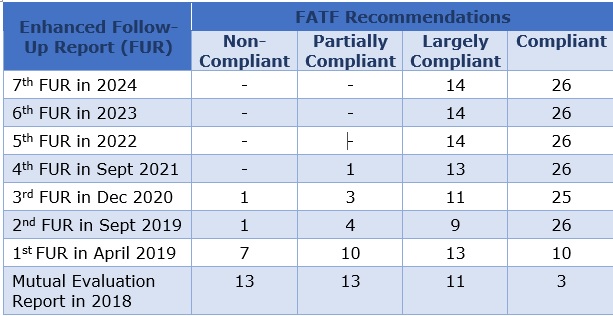

Mauritius has demonstrated a strong commitment to combating money laundering and the financing of terrorism and proliferation (AML/CFT/CPF), positioning itself as a jurisdiction of substance with a robust regulatory framework. The country is assessed as "Compliant" or "Largely Compliant" to all

40 Financial Action Task Force (FATF) Recommendations. This achievement underscores Mauritius' dedication to uphold global standards and adhere to international best practices.

Mauritius was placed on the FATF Grey List in February 2020. Subsequently, the Government of Mauritius made a high-level political commitment to work with the FATF to strengthen the effectiveness of our AML/CFT regime and prioritise the implementation of the FATF Action Plan. In this endeavour, Mauritius received technical assistance and support from a number of international organisations and development partners.

In October 2021, Mauritius successfully exited the FATF Grey List, ahead of schedule, showcasing its unwavering political determination to sustain AML/CFT reforms. This accomplishment was followed by removal from the United Kingdom's and European Union's List of High-Risk Third Countries in November 2021 and March 2022, respectively.

Despite exiting the FATF Grey List, Mauritius continues to maintain its momentum in the fight against money laundering, terrorism and proliferation financing. Amongst other measures, Mauritius carried out risk assessment exercise in relation to virtual assets and virtual assets service providers, which subsequently led to the enactment of a comprehensive legislation on virtual assets and initial token offerings.

Over the course of several ESAAMLG Task Force Meetings, Mauritius has constantly demonstrated its progress and reaffirmed its commitments to fight ML/TF/PF. The table below illustrates the progress made with respect to our compliance with the FATF Recommendations following the Mutual Evaluation Report (MER) in 2018 and the number of Enhanced Follow-Up Report (FUR) submitted:

|

|

| Key and ongoing initiatives to sustain compliance with FATF Standards

AML/CFT/CPF continues to remain high on the agenda of the Government. The following are the key and ongoing initiatives of the Ministry:

(a) The conduct of a Second National Risk Assessment (NRA), including the different sectoral risk assessments, to identify the ML/TF risks associated in Mauritius' ecosystem. (b) An Anti-Money Laundering and Combating the Financing of Terrorism and Proliferation (Miscellaneous Provisions) Act has been enacted in July 2024 with a view to amongst others, address remaining minor technical deficiencies and revisions pertaining to the FATF Recommendations, as well as legislative gaps identified during the risk assessment exercises.

(c) The organisation of an In-Country Assessor's Training in collaboration with the ESAAMLG Secretariat in May 2024, which aimed to equip the staff of different AML/CFT institutions with the necessary skills for the forthcoming Mutual Evaluation scheduled in 2027.

(d) Undertaking a mid-term independent assessment to evaluate the technical compliance and effectiveness of Mauritius' AML/CFT/CPF Framework with respect to the revised FATF Methodology.This proactive review aims at identifying deficiencies and implementing corrective measures ahead of the next Mutual Evaluation exercise.

(e) Conducting risk assessments to better identify and understand ML/TF/PF Risks associated, including the review of ML/TF Risk related to Legal Persons/Legal Arrangements as well as Virtual Assets/Virtual Asset Service Providers, Terrorism Financing risks linked to Non-Profit Organizations, and the first Proliferation Financing (PF) Risk Assessment.

Mauritius remains committed to consolidating capacity building, training and awareness raising programs. In this regard, trainings, outreach activities and workshops are organised on an ongoing basis with the collaboration of development partners and support of international institutions. With a view to continue enhancing regional and international cooperation, Mauritius is also assisting other countries by sharing its experience gained and lessons learned in tackling ML/TF.

|